Another brick in the wall? The Belgian urge to build their own home

An overview and quick indicative valuation of your real estate in KBC Mobile and KBC Touch thanks to an AI model.

According to figures from the European Central Bank (ECB)

- roughly seven out of ten Belgian households own their own home. This rate of home ownership is higher than the euro area average, where six out of ten households are owner-occupiers.

- In addition, almost one in five Belgian households also own additional property (apartment to let, second home, building plot, etc.), though that figure is lower than the figure for the euro area (one in four).

Figures published by the National Bank of Belgium (NBB) show that

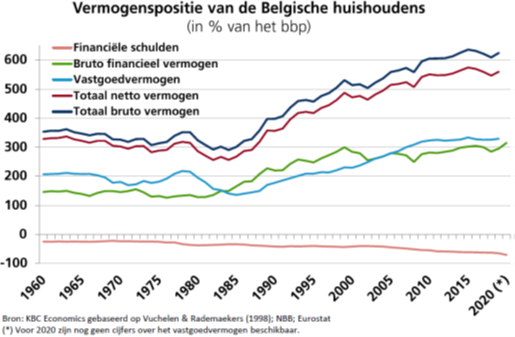

- since 2006 the total assets held in real estate by Belgian households have exceeded their financial assets (see figure),

- and accounted for 52.7% of total gross assets in 2019.

According to figures from the Land Registry, the number of individual homes (the principal real estate component) in Belgium increased by 26% between 1995 and 2020.

Unique real estate overview, a first for Belgium

In short, real estate occupies a key place in the assets of Belgians. The Belgian would therefore like to have a clear overview and an idea of the value of that 'brick in his stomach'.

KBC Private Banking & Wealth clients now also have a user-friendly application to obtain an estimated valuation and overview of their residential real estate in KBC Mobile and KBC Touch.

The client records their real estate in the application, they receive an immediate estimate of the value of their real estate assets. The expected value of a building is provided by an AI model, a state-of-the-art algorithm which uses historical sale prices of buildings financed by KBC to learn which characteristics of a property determine the price. These characteristics are drawn from public sources, such as Land Registry and Statbel data.

The algorithm takes into account building characteristics such as the size, but also includes the characteristics of the plot. It also takes into account information about the immediate neighbourhood and wider setting, such as accessibility, noise nuisance, proximity of shops and many other factors. The predicted prices are also automatically adjusted in line with the latest trends in property prices. Clients can further refine the valuation by entering additional information such as year of build, number of bedrooms, EPC rating, etc.

The estimate is updated each time the client consults the application, taking into account the latest market conditions. Currently clients can register apartments, houses and building plots located in Flanders and Brussels. The intention is to expand and refine the application.

The application was first opened to customers in Flanders two months ago. Two months after the launch, 8% of the digitally active KBC Private Banking and Wealth customers used the application.

Since 13 April the application has been available to KBC Brussels private banking clients. Soon KBC and KBC Brussels clients will also be able to include properties in Wallonia in the application. From then on the application will also be available for CBC Private Banking clients.

Regine Debeuckelaere, General Manager KBC Private Banking & Wealth, says: 'This application is unique in the market because it allows the client to store information about their real estate conveniently in one place. Each time the client consults the real estate tool in KBC Mobile or KBC Touch, they receive an immediate update of the valuation(s) of their real estate. So the client receives a complete overview of their assets at a stroke. This is entirely in line with the strategy of KBC Private Banking & Wealth to make it easier for its clients to manage and keep track of their total assets.'

The Belgian urge to build

It is often said that Belgians are ‘born with a brick in the stomach’. This popular saying has been around for a long time; it spread after the Second World War, when most Belgian families were keen to have their own place to call home.

Johan Van Gompel, Senior Economist at KBC Group, has collected the available data and set out a few facts: 'That ‘brick in our stomach’ means that 71.3% of the Belgian population now own their own home (Eurostat figures 2019).Expressed as a percentage of the population, that rate of home ownership is higher than the average in the European Union (69.2%) and the euro area (65.8%).However, Belgium is by no means the leader of the field in Europe. That position goes to Romania, where home ownership is no less than 95.6%.Moreover, 17 countries in the EU have home ownership rates that are higher than in Belgium. The fact that the figure for Belgium is still higher than the European average is explained by the very low figures in the large EU member states: 51.1% in Germany and 64.1% in France.'

The Household Finance and Consumption Survey carried out by the European Central Bank (ECB) in 2017 expresses home ownership as a percentage of the total number of households. The figure for Belgium turns out at 69.3%, compared with 60.3% for the euro area. The survey also asks households about ownership of any additional real estate (second home, building plot, garage, etc.).According to the 2017 survey, this figure is considerably lower in Belgium (18.9%) than in the euro area as a whole (24.8%). Overall, 72.4% of Belgian households owned one or more forms of real estate in 2017, compared with 64.7% in the euro area. This suggests that total ownership of real estate in Belgium at that time accounted for 65.1% of total gross household assets (i.e. excluding debts). That is slightly lower than the figure for the euro area (67.6%).

The National Bank of Belgium (NBB) also publishes figures on household assets in Belgium. In contrast to the ECB survey, the NBB figures are based on ‘hard’ data from the National and Financial Accounts. The figures suggest that the real estate assets of Belgian households (own home plus additional real estate) has outstripped their financial assets since 2006 (see figure)and accounted for 52.7% of total gross assets in 2019. That is slightly lower than the figure produced by the ECB survey discussed above. Apart from the differing approaches, the difference is also likely to be related to the fact that the NBB figures do not include real estate held abroad by Belgians due to a lack of quantified information on this.

In 2019, the total real estate owned by Belgian households amounted to 329% of Belgian Gross Domestic Product (GDP, the total value of all goods and services produced within Belgium’s borders per year). Gross household financial assets at that time (excluding debts) amounted to 296% of GDP. Household assets, and especially real estate assets, have proved to be resilient to the various crises that have occurred over recent decades. The sharp increase in real estate assets since the 1990s was due more to the strong upward trend in property prices than to an increase in the volume of real estate. According to figures from the Land Registry, the number of individual homes (the principal real estate component) in Belgium increased by 26% between 1995 and 2020. House prices rose much more steeply over the same period, by 240%. That increase in house prices was in turn due mainly to the relatively sharp rise in land prices. In 1995, 55% of the total real estate assets consisted of buildings and 45% of land (for built plots, buildings and land are treated as separate from each other). In 2019 these proportions had changed to 38% buildings and 62% land.