41% of KBC customers consider buying an electric vehicle but are hesitant and expect incentives.

KBC offers a lower interest rate on car and bike loans and a discount on car insurance.

KBC surveyed a broad group of customers about their intentions to purchase a vehicle (electric or otherwise) and the factors impacting their decision.

- 41% of the almost 1 500 retail customers surveyed are thinking about buying an electric or plug-in hybrid vehicle.

- Customers are putting off the decision due to a number of clear obstacles such as the purchase price and driving range of the vehicle, battery life and the availability of charging stations.

- Customers could also be convinced to buy when financial incentives are available.

KBC is addressing this expectation by offering a lower interest rate on car loans and a discount on car insurance. In addition, the bank is working with an external partner who can assist customers with the installation of solar panels and a home battery if they choose to drive an electric vehicle.

Obstacles and incentives play a major role when purchasing an electric vehicle

- What factors play a role in deciding whether or not to buy an electric vehicle?

- The purchase price is the main factor, in addition to

- the driving range of the vehicle

- battery life

- and the availability of charging stations

- Interestingly, 40% of respondents said the driving range should be between 400 and 600 kilometres.

However:

- 78% report driving an average of less than 50 kilometres a day

- 25% report driving no more than 10 kilometres a day

- only 2% drive more than 150 kilometres

64% of customers considering an electric vehicle only want to buy a new electric or plug-in hybrid vehicle, with the condition of the battery in a second-hand vehicle and rapidly evolving battery technology being instrumental in their thinking.

Retail customers’ hesitant behaviour reflected in KBC lending

- The number of loans granted by KBC for second-hand vehicles (cars over three years old) increased by 31% in 2023 (compared to 2022).

- 10% of loans granted for cars under three years old were for electric vehicles. Nevertheless, 41% of surveyed customers are considering switching to an electric or plug-in hybrid vehicle for their next car, indicating a clearly growing interest among private individuals to buy an electric vehicle.

- For other car loans (for new vehicles), this increase was limited to 15% compared to 2022.

Various factors serve as key incentives when buying an electric vehicle

- 70% of the surveyed customers see the appeal of tax incentives such as exemption from annual road tax, vehicle registration tax and government subsidies when purchasing an electric vehicle.

- 60% of potential buyers also clearly indicated that the reduced environmental impact and cheaper energy are important incentives for making a purchase.

- Customers are also looking to KBC for support:

- Financial benefits

- 57% expect a discount on their insurance premiums

- 53% expect a discount on their loan to purchase an electric vehicle (a third of the customers surveyed are considering taking out a loan for their purchase)

- Additional services: A third of customers also expect additional support from KBC and a personalised proposal regarding the need for additional solar panels or a smart home battery when they decide to buy an electric vehicle.

- Financial benefits

KBC is addressing these expectations directly by offering customers and non-customers discounts on car and bicycle loans and car insurance, as well as providing assistance when it comes to installing solar panels and a home battery:

ATTENTION, BORROWING MONEY ALSO COSTS MONEY

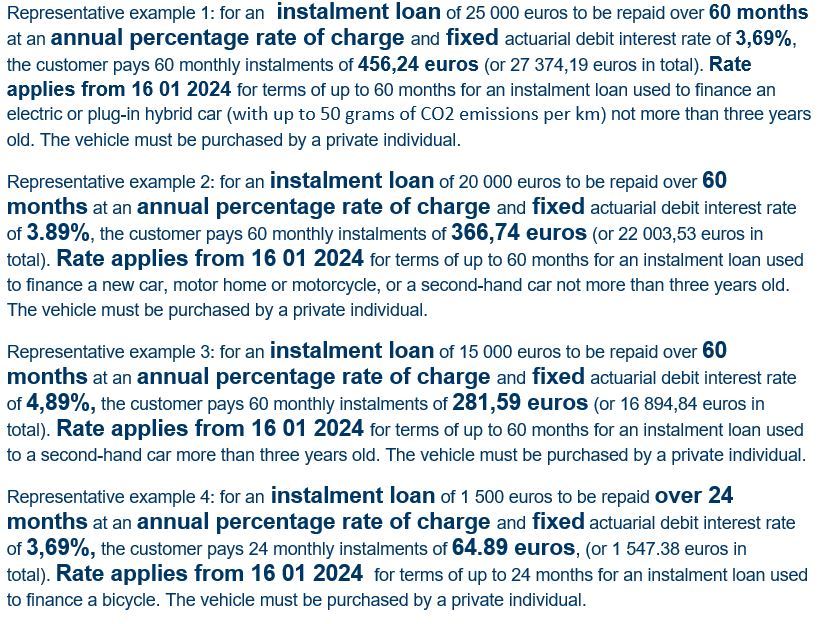

a. Discounted rates on car loans(16 01 2024 to 16 02 2024)1

- Electric or full-hybrid vehicle: 3,69 % (Representative example 1)

- Other new vehicle Second-hand vehicle (up to three years old): 3,89 % (Representative example 2)

- Second-hand vehicle (more than three years old: 4,89 % (Representative example 3)

b. Discounted rates on bicycle loans (16 01 2024 16 02 2024): 3,69 %2 (Representative example 4)

c. Until 17 March 2024, no origination fees will be charged when financing a company car: a tidy saving of 125 euros.

d. Discounted car insurance from 01 January 2024 to the end of April 2024:

- 10% off fully comprehensive insurance for electric vehicles (assistance insurance component not included)

- Up to 15% off (both fully comprehensive insurance and third-party liability insurance) for anyone driving a limited number of kilometres

e. In collaboration with its partner ‘Impact Us Today’, KBC is offering a new service in KBC Mobile that provides a personalised proposal for the installation of solar panels and a home battery. KBC customers can have a contractor visit their homes and receive a custom proposal, making the process as straightforward as possible.

Notable trends in amount borrowed and borrower profiles:

- The amount borrowed for a car remains relatively stable in comparison to 2022.

- Interestingly, the age of people borrowing for an electric car is getting younger and younger.

- The demand for bicycle loans, which had risen sharply in recent years (due in part to the pandemic), cooled somewhat in 2023 (-16%).

- 95% of bicycle loans are taken out digitally, with KBC Mobile being customers’ preferred channel for doing so.

1 Rate valid for KBC / KBC-Brussels / CBC

2 Rate valid for KBC / KBC-Brussels / CBC

| Electric | Non-electric | Second hand |

Average amount borrowed | 30 000 | 21 100 | 14 300 |

Amount borrowed as % of value of car | 67% | 74% | 82% |

Average term | 5 years (60 months) | 5 years (57 months) | 47 months |

Average age of borrower | 48 years old | 45 years old | 39 years old |

Average amount borrowed | 4 000 euros (2022: 3 900 euros) |

Average amount invested | 4 300 (same as in 2022) |

Amount borrowed as % of value of bike | 93% |

Comprehensive car insurance

Insured

- Damage caused by a collision, fire, glass breakage, theft, vandalism, forces of nature, filling up with the wrong type of fuel, collisions with stray animals or birds, and gnawing martens

- The cost of replacing locks or reprogramming the locking system if your car keys are stolen

- Medical expenses if you were injured in a carjacking or car theft

- Vehicle registration tax is covered free of charge if your vehicle is a total loss

Damage to transported items

- We compensate up to 1 500 euros for items you transport in your car which are intended for personal use in the event that your car is also damaged, including bicycles on your bicycle rack or luggage in your roof box

- We also cover any additional vehicle features which you can no longer use after your car has been declared a total loss, such as your winter tyres or roof box

Not insured

- Damage you cause under the influence of alcohol (more than 0.15%) or in a similar condition due to the use of substances other than alcohol

- Damage you cause while driving your car in violation of the conditions laid down in Belgian laws and regulations

- Damage you cause intentionally

- Damage to parts caused as a result of wear and tear or by an obvious lack of car maintenance

- Theft you facilitated by leaving your vehicle unattended on a public road or unlocked in another location accessible to the public

- Your physical injuries as the driver of your vehicle

(for which you can take out Driver Accident Insurance)

The complete list of exclusions can be found in the general conditions.

Third-party liability

What is covered?

- Loss, damage or injury you cause with your vehicle to third parties, both material (e.g., exterior damage, damage to buildings, etc.) and physical (i.e. death or injuries)

- Injuries sustained by pedestrians, cyclists or passengers in traffic accidents in which your car is involved

Even if you are not liable, you can claim on this insurance.

What is not covered?

Some key exclusions are:

- damage to your own vehicle

- physical injuries sustained by the driver in a traffic accident

- damage caused during participation in competitions

- damage you cause intentionally

The complete list of exclusions can be found in the general conditions.

Read this information carefully before taking out this insurance: Inexpensively insured? - KBC Banking & Insurance

Good to know

- This product is governed by the laws of Belgium.

- The insurance in this policy applies for a term of one year and will be tacitly renewed, unless they are terminated no later than three months before the principal renewal date.

- Your intermediary is your first point of contact for any complaints you may have. If no agreement can be reached, please contact KBC Complaints Management, Brusselsesteenweg 100, 3000 Leuven, complaints@kbc.be, tel. 016 43 25 94 (free of charge) or + 32 78 15 20 45 (charges apply), fax + 32 16 86 30 38. If you cannot find a suitable solution, you can contact the Belgian insurance industry's ombudsman service: Ombudsman van de Verzekeringen, de Meeûssquare 35, 1000 Brussels, info@ombudsman.as, www.ombudsman.as.

This does not affect your legal rights. - To request a quote for a KBC Vehicle Insurance, visit our website, KBC Mobile, KBC Touch or contact your KBC Insurance intermediary.

- KBC Vehicle Insurance is a product from KBC Insurance NV – Professor Roger Van Overstraetenplein 2 – 3000 Leuven – Belgium – VAT BE 0403.552.563 – RLP Leuven – IBAN BE43 7300 0420 0601 – BIC KREDBEBB

The company is licensed by the National Bank of Belgium, de Berlaimontlaan 14, 1000 Brussels, Belgium for all classes of insurance under code 0014 (Royal Decree of 4 July 1979, Belgian Official Gazette of 14 July 1979).

A member of the KBC Group.

|