KBC enables customers to earn money with Kate and Kate Coins

In recent years, an increasing number of KBC customers have saved time and money thanks to Kate, the personal digital assistant in KBC Mobile. Kate, who has had over 30 million interactions with KBC customers to date, is now informing customers about Kate Coins. Since the start of this year, KBC customers have been able to acquire Kate Coins when they purchase products or services from KBC and then use the Coins there. Customers can use their Kate Coin wallet in KBC Mobile to see at a glance how many Kate Coins they have acquired and used.

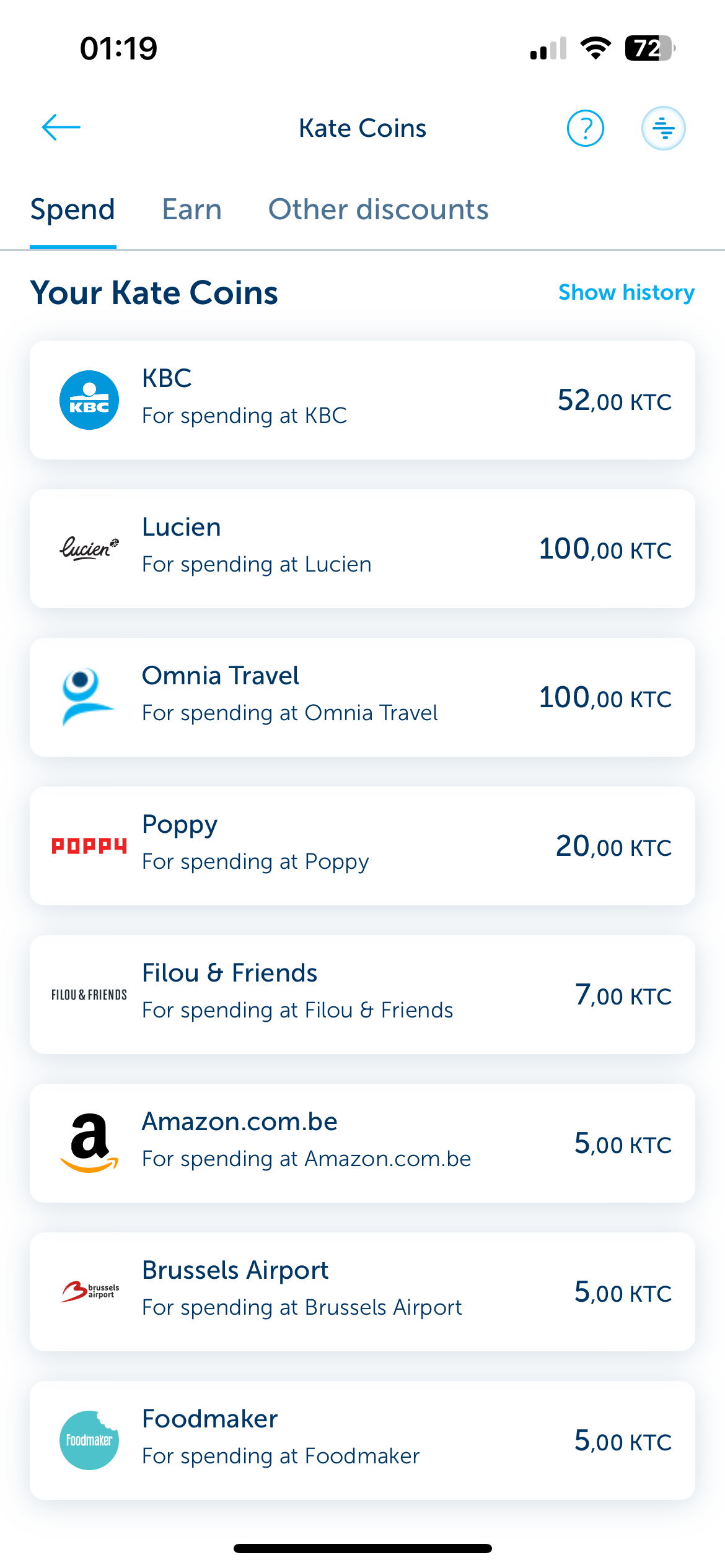

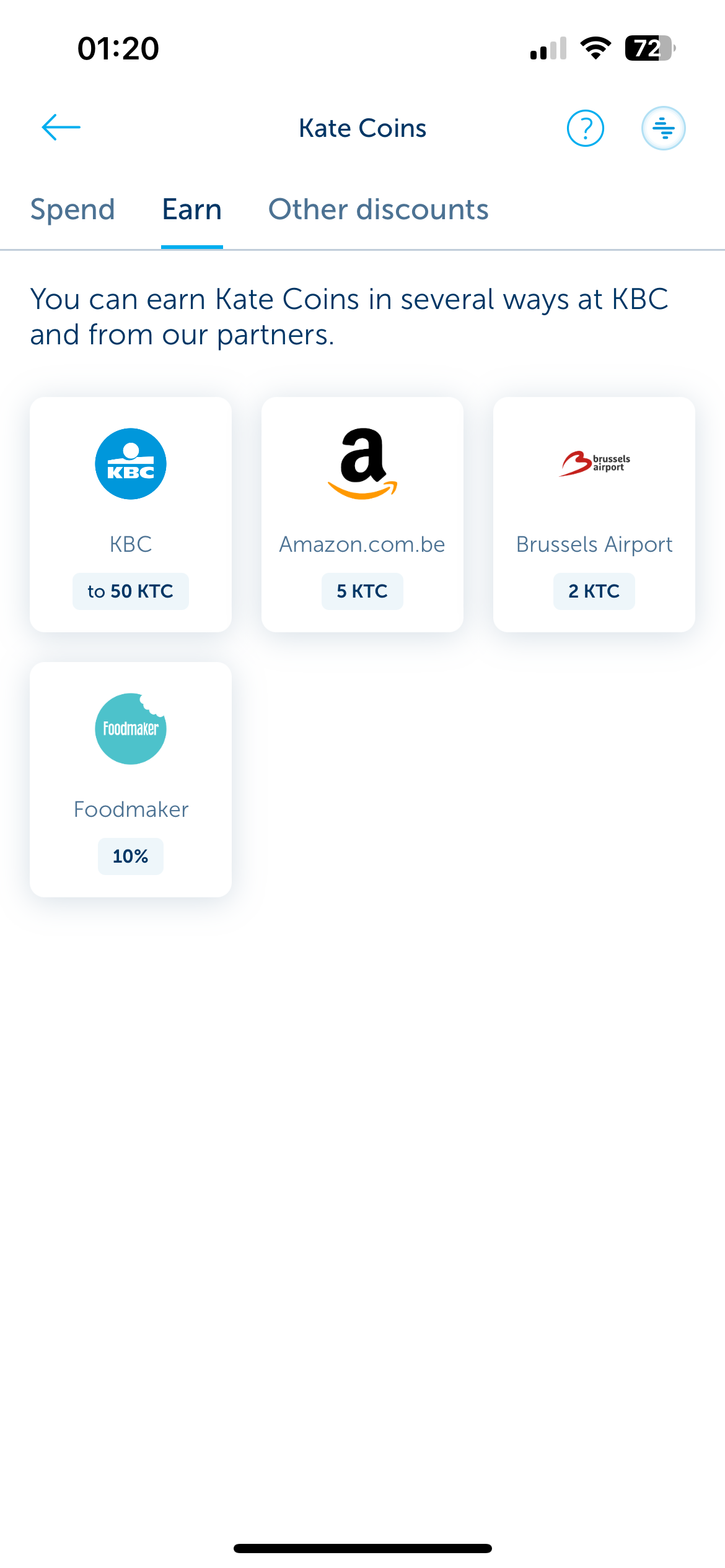

From 21 November 2023, opt-in KBC customers can acquire even more Kate Coins and enjoy even more benefits and discounts when making purchases from commercial partners such as Amazon.com.be, Foodmaker, Brussels Airport, Omnia Travel, Filou & Friends, Lucien and Poppy.

KBC will continue to systematically expand the benefits available over the next few years. The bank is looking to ensure that eventually customers will be able to acquire Kate Coins from one partner and spend them at other partners, or combine their Kate Coins together with euros when paying a specific partner.

Johan Thijs, KBC Group CEO, explains this important step: ‘At KBC we put the customer first and we’re always working to further refine and improve the customer experience. Since the beginning of this year, KBC’s retail customers have been able to opt in to acquire and also spend Kate Coins. At first, this option was only available within the KBC banking and insurance environment, but starting from 21 November, we will go one step further and add partnerships with our commercial partners. This marks another step forward in innovation and customer focus at KBC. What’s more, this expansion is just a stepping stone towards countless possible applications in future where Kate will help customers to save time and earn money.’

What is the Kate Coin?

Since the start of 2023, KBC customers[1] have been able to acquire Kate Coins by purchasing certain products or services from KBC, KBC Brussels or CBC[2] such as when they take out a home loan or home insurance, or start pension saving or spare change investing.

Customers can then use these Kate Coins to save money by exchanging them for additional benefits and cashback rewards from KBC and its commercial partners. For example, when arranging an investment plan, a prepaid card, personal accident insurance or family insurance, KBC customers can use their Kate Coins to immediately receive a cashback reward.

So far, more than 283 000 customers have earned KBC Coins and 46% of those customers have earned enough Kate Coins to spend afterwards.

What will change on 21 November 2023?

From 21 November 2023, KBC is significantly expanding the number of options available for spending Kate Coins, as well as the opportunities for acquiring them. Customers will acquire Kate Coins when they purchase a product or service from KBC or buy something from one of its partners.

The key difference now is that KBC customers will be able to acquire or spend Kate Coins when making a purchase from any of the following commercial partners: Amazon.com.be, Brussels Airport, Omnia Travel, Filou & Friends, Poppy, Lucien and Foodmaker. Customers will receive a cashback reward, either immediately or following their next purchase from the partner in question. Partners are free to decide the terms, conditions and timing of their offers.

Therefore, it will certainly be worthwhile for customers to check the offers available in KBC Mobile before making a purchase as they could be pleasantly surprised by how much they save!

KBC will continue to systematically expand the available benefits

KBC customers will be able to acquire and spend Kate Coins at a steadily increasing number of partners.

Starting in early 2024, KBC customers will earn Kate Coins when they use their credit card or simulate their renovation in Setle. They will also be able to spend their Kate Coins when they sign up for additional services linked to their credit card, take out bike insurance, travel insurance or home assistance insurance, and when they purchase solar panels through Impact. New benefits and discounts from partners will be unveiled by KBC on a monthly basis.

KBC is also looking to ensure that Kate Coins acquired from one partner can also be spent at other partners.

In KBC Mobile, customers will be able to keep track of which new partners are offering the chance to earn money, thanks to their digital assistant Kate who can now speak to them in German in addition to Dutch, French and English.

In the Kate Coin Wallet in KBC Mobile, customers can see how many Kate Coins they have earned from KBC and its various partners, as well as see how many they have already spent.

[1] Any reference to KBC customers also includes customers of KBC Brussels and CBC.

2 Customers can only acquire and spend Kate Coins at KBC if they have opted for ‘Extra convenience’ in their privacy settings in KBC Mobile. To earn and use Kate Coins with commercial partners, they must also select ‘Personalised’ in their ‘Commercial settings’.