Belgians and the energy transition: high costs inhibit investments

KBC market survey 2024

KBC lowers interest rates KBC energy and renovation loan

For the second year in a row, KBC, in collaboration with Profacts, has conducted a market survey of 1 000 Belgian respondents across various age groups. The survey was conducted mainly among homeowners. The focus this year was on the attention respondents pay to the Energy Performance Certificate and its impact on energy consumption. KBC also explored what efforts those surveyed would be prepared to make to consume less energy and what is currently stopping them from making those investments. KBC observed:

- The energy transition is here to stay

- Financial aspects play a major role in making investments

- There is too much information and too little knowledge among those surveyed

In addition, KBC Bank also analyzed its own loan portfolio and this yielded some striking trends.

KBC wants to support its customers in the sustainable transition with the help of professional partners and adjusted interest rates for the KBC energy and KBC renovation loan.

The energy transition is well established

- 78% of respondents said they had made efforts to reduce their daily energy consumption in the past year; half of them made even greater efforts than the year before.

- A third of respondents monitor their energy consumption monthly; 37% once or a few times a year, and 8% never do so. The majority monitor their consumption using their meter or through their energy supplier.

- Almost all of the respondents believe it is important that their own home is energy efficient, but one in two say their home is moderately or not at all energy efficient.

- 60% would like to invest in smart tools to optimise their energy consumption. Among respondents between 18 and 34, this is 73%.

- The EPC rating is an important consideration for 9 out of 10 Belgians when buying a home. Among respondents up to 34 years old, this is even higher (97%).

KBC’s own loan portfolio suggests that demand for energy loans is very much driven by market trends:

- 2020: High demand for solar panels given planned abolition of the reverse counter for electricity

- 2022: Very strong interest in and demand for energy-saving measures in the wake of the energy crisis following the outbreak of war in Ukraine

- 2023: Demand for solar panels remains high, albeit less pronounced due to the reduction/decrease in energy prices (less impact from premium ending towards the end of the year)

Financial aspect plays major role in decision whether or not to make technology investments

- Solar panels are by far the most established and their ownership is set to increase, with 1 in 5 saying they would like to install them in the (near) future.

- Other technological investments are lagging somewhat behind. Still, quite a few of the homeowners in the market survey indicate that they want to make the following investments in the (near) future: home battery 33%, charging station 28%, heat pump 27%, solar water heater 23%, solar panels 22%. This primarily to save on energy bills.

- 60% of respondents said they would not invest in technology at all, mainly because of the high cost.

KBC sees these trends reflected in the number of KBC Energy Loans granted (KBC figures in Flanders and Brussels):

- 2022 was an absolute peak year in which the number of energy loans increased by 156% compared to 2021, as did the volume of loans, which rose by 162%. This can be attributed to the energy crisis.

- After the absolute peak year of 2022, it is little surprise that the bank recorded a lower number and volume of energy loans in 2023 (-35%). A similar though less pronounced trend (-14%) also applied to traditional renovation loans, mainly due to the sharp increase in construction costs and rising interest rates.

- However, over a slightly longer period, a comparison of the 2023 figures against the 2019 volumes shows that the trend continues upwards:

- A steep (86%) increase in the number of energy loans (2023 vs 2019)

- In volume terms, a very strong increase of 128% (2023 vs 2019)

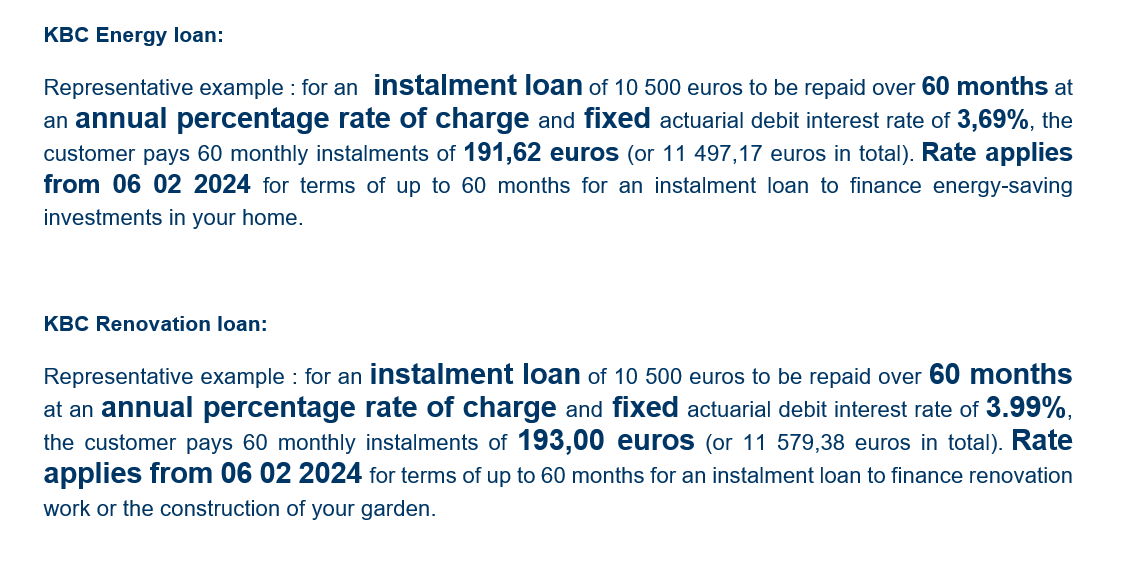

To help customers in their energy transition, KBC is offering favorable rates on the energy and renovation loan in February1 :

- KBC Energy Loan: 3.69%

- KBC Renovation Loan: 3.99%

ATTENTION, BORROWING MONEY ALSO COSTS MONEY

Oversupply of information and lack of knowledge create need for reliable partners

- 44% of respondents admit to having little or no knowledge about energy and the energy transition.

- Three out of four have no idea what the capacity tariff means for them, or have never heard of it.

- The vast majority of respondents (over 80%) are willing to take additional measures over and above the efforts they have already made. One in two would also like to optimise their energy consumption but do not know how. They are confronted with an oversupply of information on the topic: no fewer than 63% say they do not know how to navigate all the details and feel overwhelmed by all the changes coming their way.

- 60% of those surveyed would therefore find it helpful for their bank to support them by providing information and putting them in touch with reliable partners.

KBC makes it easy for customers with tools in KBC Mobile

Together with a number of professional partners, KBC wants to help customers better understand their energy consumption and help them optimise it by making appropriate adjustments such as renovating, insulating and installing solar panels.

- Immoscoop in KBC Mobile allows customers to start the search for a future home.

- Those who want to estimate the investment cost of renovation works can use Setle's renovation simulation and advice tool in KBC Mobile. As of mid-2022, more than 26,000 customers were already using Setle in KBC Mobile. The renovation report created by Setle is also accepted by KBC when applying for a loan (energy loan, renovation loan,...).

- Since the end of November 2023, KBC customers have been able use KBC Mobile to have selected contractors (through our partner Impact Us Today) visit their home to discuss their options and receive a quote for insulating their home or installing solar panels and/or home batteries. If the customer agrees, they can then proceed with installation. Over 400 customers have already requested a quote. The first installations are scheduled to start from February.

- In case of a major renovation, additional KBC insurance during the works and update of the policy after the works is appropriate. The trusted KBC insurance agent and/or KBC (Live) office employee, as well as Kate, can guide and advise the customer.

- Thanks to the 'Energy Insights' feature in KBC Mobile, customers can closely monitor their electricity and gas consumption and compare with similar households, and receive tips on how to reduce their energy consumption.

- Since December 2023, KBC customers can use the ‘Energy Dashboard’ in KBC Mobile to help them become more energy efficient and save on their energy bills. By answering a few questions about their home, customers create their own Energy Dashboard, where they will receive personalised advice and tips. More than 31,000 customers have used the feature so far.

1 Rate valid from February 6 for KBC / KBC Brussels and CBC