KBC presents its first Climate Report setting out specific targets for reducing future CO2 emissions

At a press meeting today, KBC Group CEO Johan Thijs elaborated on KBC Group's Climate Report.

Johan Thijs: ‘At KBC, we’ve been focusing on climate since 1970, when founding Argus, our Foundation for scientific, environmental research, and educating and raising awareness among the general public regarding environmental policy and rehabilitation. We’d already set ambitious targets in the past, which each time we had met and exceeded. But in 2019, we shifted up a gear by signing up to the United Nations' Collective Commitment to Climate Action and undertaking – in collaboration with our customers – to promote the maximum greening of the economy in an effort to limit global warming to well below 2°C and work towards hitting a target of 1.5°C, as set out in the Paris Agreement. In recent years, we have already taken important steps to help curb global warming.

The Climate Report, which we published on 30 September and are looking at in more detail today, outlines our vision and ambitions for climate policy in the area of lending and asset management throughout the group in the years ahead.

This is reflected in the ambitious new targets set out in the report as regards the impact of our loan portfolio and asset management activities on climate. These come on top of the policy guidelines we apply specifically to our customers' activities in a number of key sectors. For us, these sectors represent the highest risk of exposure to CO2 emissions and accounted for two-thirds of the estimated financed CO2e emissions associated with our lending activity at the end of 2021.

Even though the quality of the data, just as accuracy of the methodologies used worldwide are still not always optimal, we’re assuming our responsibility and setting specific climate targets and actively helping to create a low-carbon, sustainable society. The targets provide a transparent framework of where we want to go as a company in the short term (2030) and in the longer term (2050), both in terms of ourselves and our customers. Our current targets relate to lending and asset management. At present, not enough recognised research and reporting methods are available for insurance activities.’

Filip Ferrante, General Manager of KBC Group Corporate Sustainability, adds: ‘KBC's Climate Report contains analyses and targets for the energy, real estate, transport, agriculture, construction and metals sectors, some of which have been broken down into sub-sectors. We have set specific and measurable targets for these sectors and aim to hit those targets by 2030. They are based on currently accepted science and our own assessment of what is economically and technically feasible for those sectors. We have incorporated all this information into White Papers for each sector. The targets take account of the economic and social fabric and therefore should be interpreted in a broader sense rather than purely in terms of climate-related issues. This allows us to maximise the role we play in society and to help facilitate the necessary, but achievable, transition to a more sustainable society for our customers. We will provide maximum support and guidance for this transition in the form of financial and technical expertise, without compromising our efforts to achieve the climate targets we’ve set ourselves.

A comprehensive and transparent overview of our ESG achievements and progress made in the past year, along with our sustainability ambitions, are set out in the KBC Sustainability Report which was published in April 2022. This report also includes figures for KBC's indirect environmental footprint for the first time.’

Each sector faces specific challenges

Not all sectors will be able to reduce their CO2 emissions at the same rate and to the same extent, given that they each face different economic and technological challenges. KBC's decarbonisation ambitions primarily concern the real estate and energy sectors, but they also cover the transport sector. These sectors are where KBC can exert most financial leverage to help achieve transition. It’s also why KBC is taking the lead and treating its own home loan portfolio as a specific sub-sector, just as it does its lending activities and car and light-duty vehicle leasing business.

For some sectors, the immediate reduction of greenhouse gas emissions is far from obvious because new technologies are still lacking or because - as in agriculture - the effects of a number of natural processes must be taken into account. KBC has already set clear objectives for these sectors as well.

KBC has already taken a series of concrete initiatives to assist customers in their transition to more sustainable business operations

KBC works with specialised external partners to help its customers transition to more sustainable business operations.

- Together with Encon, KBC has already had more than 340 meetings with major corporate customers to help them make their business processes more sustainable. This has resulted in more than 200 advisory contracts.

- Following the example set by the partnership with Encon for corporate customers, SMEs will soon be able to receive climate-related advice from KBC Sustainability Services, a specialised KBC subsidiary.

- In collaboration with EDI, KBC guarantees the installation of 2 000 electric vehicle charging stations at a keen price and with tax breaks for SME customers.

- KBC Autolease is the clear market leader in bicycle leasing for employees. At present, more than 80% of new leases are for more sustainable means of transport (bicycles, electric cars, hybrid cars). 67% of new car leases are currently for electric or hybrid cars (almost as many as for vehicles with conventional combustion engines in 2020).

- KBC gives private customers the opportunity to compare energy prices and switch to a better deal thanks to Mijnenergie.be in KBC Mobile.

- Setle is a tool to help estate agents arrive at a realistic estimate of the expected cost of renovating a property.

- KBC Belgium is working with Belgian start-up, Claire1, to accelerate the roll-out of carbon farming practices2 in Belgium

- …

KBC sets targets for its loan portfolio

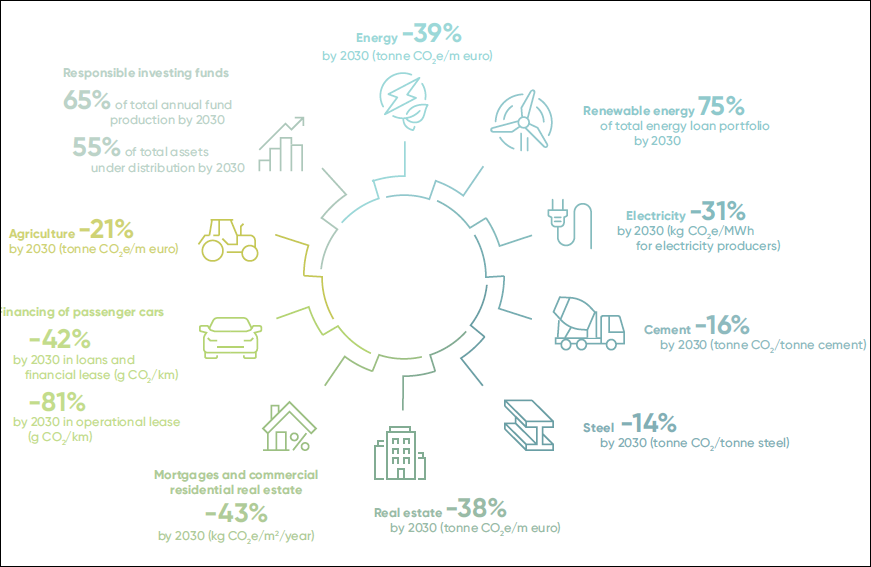

KBC has set the following targets for its loan portfolio:

When interpreting the diagram setting out the key targets, it is important to relate the percentages shown to the measure (‘metric’) used. KBC aims, insofar as is possible, to use physical emissions intensity metrics (e.g., grams of CO2 /km for cars), but such data is not yet available for every sector. For the moment, therefore, KBC is using targets based on financial intensities as an alternative (e.g., tonnes of CO2 /m euros of financing in the energy sector). For a detailed overview of all the targets, please refer to the Climate Report.

KBC also sets responsible investing targets

KBC operates not only as a lender, but also as an asset manager. Over the past few decades, KBC has taken on the role of pioneer in responsible investing. It is still doing that today and will continue to do so in the future. At the end of 2021, 31.7 billion euros’ worth of financial assets were managed responsibly at KBC Asset Management. Of every 100 euros that are currently invested, more than half is invested according to responsible investment criteria. This gives KBC Asset Management plenty of financial clout to facilitate the transition to a carbon-neutral society. It is for this reason that the Climate Report includes a specific section dealing with targets for KBC Asset Management

KBC communicates its sustainability policy, targets and achievements in an open and transparent manner

The Climate Report supplements KBC's Sustainability Report. It is a technical document aimed primarily at sustainability experts, but is of course freely available to anyone interested in this subject area. It is only available in English.

KBC's business activities in Belgium are represented most, proportionally speaking, in the Climate Report, but the activities in Central Europe will take on increasing importance in future editions.

The report is one of the commitments undertaken by KBC in 2019, when it and other leading international financial institutions signed up to the United Nations' Collective Commitment for Climate Action (CCCA). Within three years of joining, members are required to set specific targets to bring their financial flows into line with the Paris Agreement (i.e. to limit global warming to below 2°C and preferably to 1.5°C).

PricewaterhouseCoopers audited the calculated baseline for the climate targets set by KBC for its lending activities, as set out in the Climate Report.

1 Website only available in Dutch

2 ‘Carbon farming’ is a general term for agricultural practices that aim to store carbon in the soil. This enriches the soil, improves soil structure and ensures farmers receive compensation for their efforts in the form of ‘carbon credits’ that can be traded on a dedicated platform. Farmers can also obtain carbon credits in exchange for using carbon sequestration techniques.